New evidence presented at the annual meeting of the American Public Health Association in New Orleans* suggests that alcohol tax increases not only reduce the harms resulting from alcohol consumption in a population, but they may lead to a small net increase in the number of jobs. New research of scientists with the University of Illinois in Chicago and the Center on Alcohol Marketing and Youth (CAMY) at the Johns Hopkins Bloomberg School of Public Health, shows that even modest increases in alcohol taxation can lead to a net gain in employment.

We have known for a long time that taxes on alcohol are the single most high-impact and cost-effective tool to improve public health through addressing alcohol harm. Higher taxes lead to higher prices which decreases levels of consumption and related harm.

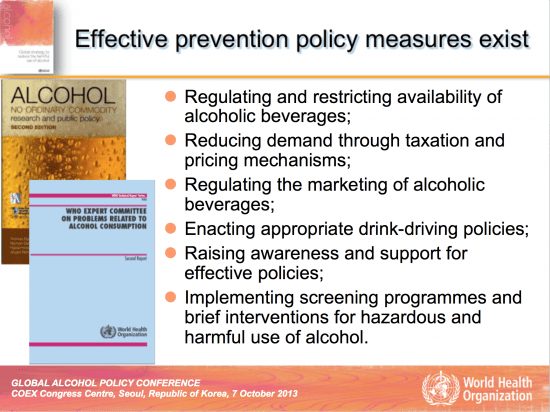

This slide from a WHO presentation at the Global Alcohol Policy Conference in Seoul, South Korea, 2013, summarizes what independent science has well-established by now.

Effective prevention policy measures do exist and among them is alcohol taxation.

Alcohol taxation – a best buy

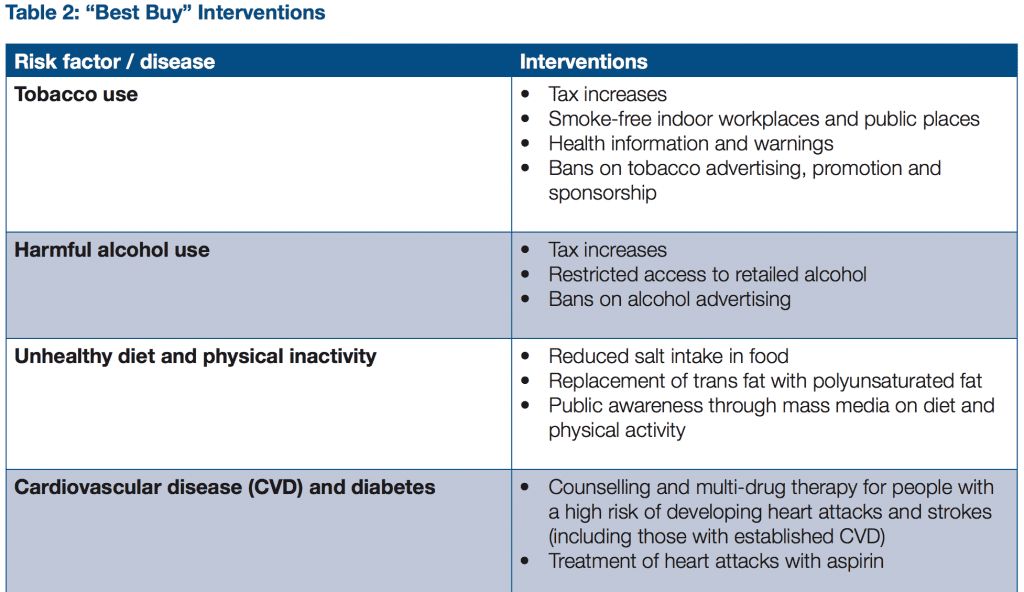

In fact, alcohol taxation is considered one of the “Three Best Buys” according to the World Bank, the WHO, the World Economic Forum and Harvard School of Public Health.

Implementation of the alcohol policy best buys promise thus quick gains across the spectrum of the burden of disease due to alcohol.

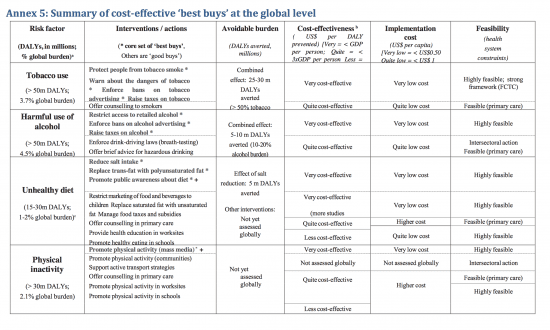

An alcohol policy best buy is an intervention that is not only highly cost-effective but also cheap, feasible and culturally acceptable to implement.

A highly cost-effective intervention is one that, on average, provides an extra year of healthy life (equivalent to averting one DALY) for less than the average annual income per person. Analysis by the World Health Organization (WHO) has identified a set of affordable, feasible and cost-effective intervention strategies and its study estimates a global price tag for implementing these measures.

Cost-effective measures for reducing harmful alcohol use include increasing alcoholic beverage taxes, regulating the availability of alcoholic beverages, restricting marketing of alcoholic beverages and drink-driving countermeasures.”

World Health Organization, NCDs Report

Alcohol taxation is good for public health

The “NCD ROADMAP REPORT” of July 2014 for Economic and Health Ministers in the Pacific Region provides another interesting diagram. It shows that raising taxes on alcohol is very cost-effective and that the implementation costs are very low. Additionally there is high feasibility for intersectoral action. When alcohol taxation measures are being used – especially when they are integrated with the other “Best Buys” – the costs that alcohol harm causes a society can be vastly reduced. In the EU, for instance, alcohol causes costs of €156 billion every year. In the United States the costs of alcohol harm amount to $249 billion.

Alcohol taxation is good for public health. This truth is widely accepted among independent scientists, public health experts, civil society and law-makers. It’s a proven scientific fact that is only challenged by the alcohol industry and their lobby groups.

- Big Alcohol claims dramatic job losses from tax increases.

- Big Alcohol also claims to be harmed by excise taxes and that alcohol was overtaxed.

- Big Alcohol also invokes the notorious black market and that tourism was undermined by alcohol taxation.

- It claims that higher taxes unfairly punish the ordinary person.

Our friends at Alcohol Justice have prepared a very useful fact sheet that investigates the merits of these alcohol industry claims and provides evidence: “Increasing Alcohol Taxes – Reality vs. Industry Myths“.

More jobs, not less

The important point in this blog is: New research exposes the Big Alcohol myth that alcohol taxation leads to job losses. It shows that alcohol taxation can in fact lead to more employment opportunities.

The mechanism is this: while losses of jobs in the alcohol industry itself will occur, the money that consumers will not spent on alcohol combined with the newly raised tax revenues for the government are going to yield more spending in other sectors, on other goods and services. This will lead to more jobs being created in non-alcohol sectors. The losses that the alcohol industry has to face, will be offset by gains in other sectors.

Additionally, those alcohol users who consume alcohol heavily pay more of the taxes than those users who consume less often and fewer quantities. This means that the strongest arguments that Big Alcohol has been using to undermine public health-oriented alcohol taxation, are debunked by independent science.

New research gives alcohol policy advocates another solid argument to counter Big Alcohol myths about the negative impact of alcohol taxes on the economy.”

Maik Dünnbier

It is worth noting that most countries around the world, especially high-income countries, do employ alcohol taxation policies but have not updated their respective taxation level according to inflation rates. Inflation has caused for alcohol taxes to continue to decline in real value over the years, meaning alcohol is becoming more affordable. For example in the United States, federal excise taxes have declined 41% in real value since the last time they were raised in 1991 because they have not been adjusted for inflation. This decline costs the federal government approximately $7 billion each year.

Alcohol taxation can meaningfully be used to tackle the tremendous burden that alcohol harm places on societies. In New Hampshire, alcohol harm costs the state’s economy more than $1.8 billion in lost productivity, law enforcement, medical expense and slower economic growth. Public health advocates in the state are asking for more profit from state liquor stores to go toward helping people with alcohol problems in New Hampshire. Higher alcohol taxes that are used to raise financial resources for better prevention and health promotion are thus a cost-effective and impactful way to go.

I also hope that this new research will help support lawmakers and governments to protect existing alcohol legislation in jurisdictions where evidence-based alcohol policy solutions are in place. For instance, in Utah the Governor has come under pressure by the results of a statewide poll released by UtahPolicy.com. The survey among 402 registered voters, showed that two-thirds of Utahns believe the restrictive state liquor laws are a detriment to economic development.

The new research gives advocates for evidence-based alcohol policy solutions another solid argument to counter Big Alcohol myths about the negative impact of alcohol policy making on the economy.

With the evidence that is now piling up, I think that advocates for public health, social development and economic productivity can feel confident in including alcohol policy measures, such as taxation, into the mix of measures that yield benefit across different sectors.

*Experts note that studies presented at medical meetings are typically considered preliminary until published in a peer-reviewed journal.

For further reading

WHO Europe: “European status report on alcohol and health 2014. Pricing policies”

Newswise — New Orleans: “Alcohol Taxes Can Improve Health, Lead to More Jobs“

Distilled Spirits Council Response to Alcohol Tax Study